Mid-Year Economic and Fiscal Outlook (2025-26)

On 17th December 2025, Treasurer Jim Chalmers and Finance Minister Katy Gallagher released the Albanese Government’s mid-year budget update.

The complete Mid-Year Economic and Fiscal Outlook (MYEFO) budget document can be accessed here.

Stronger Budget

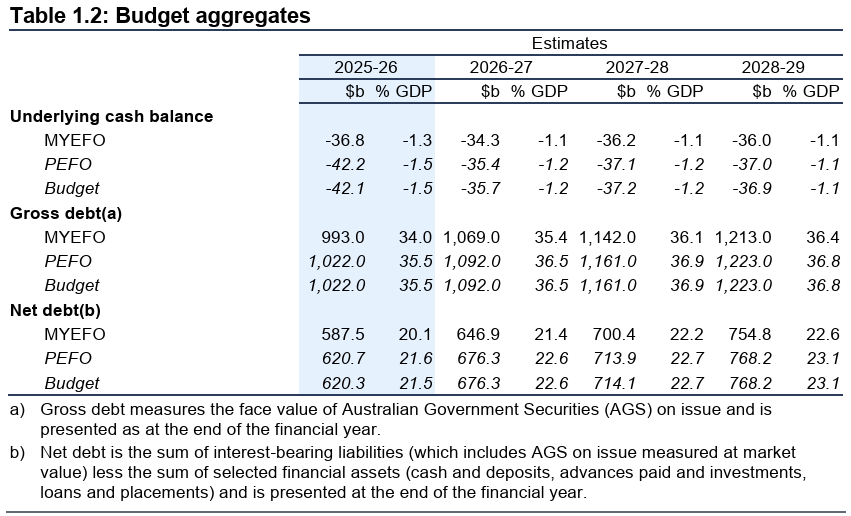

The 2025–26 Mid-Year Economic and Fiscal Outlook (MYEFO) delivers a stronger budget, with lower deficits and less debt over the forward estimates. This stronger budget position has been achieved by identifying an additional $20.0 billion in savings and reprioritisations, limiting spending growth and returning every dollar of tax receipt upgrades to the budget. For the first time in eight years, net policy decisions in this MYEFO are positive, improving the budget position by $2.2 billion over the forward estimates.

The Government has delivered improvements to the budget despite challenging global conditions and the need to fund $6.6 billion of urgent and unavoidable spending and $35.1 billion in upwards payment variations, mostly reflecting increased demand for government payments and services, and automatic updates to estimates. This includes funding recovery from natural disasters, providing access to new medicines and sustaining core services for veterans.

Key Areas of Focus

The Governments MYEFO mainly focuses on delivering the election promises it took to the May 2025 election. This includes:

- cost-of-living relief: continuing to roll out tax cuts to every Australian taxpayer and a better deal on their energy bills and at the checkout

- strengthening Medicare and investing in health, medicines and aged care

- making it easier to buy and rent a home

- investing in cleaner energy, and building a Future Made in Australia – through the Cheaper Home Batteries Program, onshore production of low-carbon liquid fuels, establishing a critical minerals strategic reserve and implementing the Government’s Net Zero Plan

- economic reform – to make the economy more productive and resilient – by working with the states and territories on competition reforms, accelerating approvals and investing in infrastructure priorities

- broadening opportunity, advancing equality and improving social services – by ensuring fairer superannuation tax concessions for low-income workers, advancing First Nations economic empowerment and making early childhood education and care safer and more accessible

- securing ‘home and region’ – by investing in defence infrastructure, enhancing emergency capability and supporting the growth, resilience and sustainability of regional areas and local communities.

Further Information

For more information, please contact Hawker Britton’s Partner and CEO Simon Banks on +61 419 638 587.

Additional Occasional Papers published by Hawker Britton are available here.

Key Figures

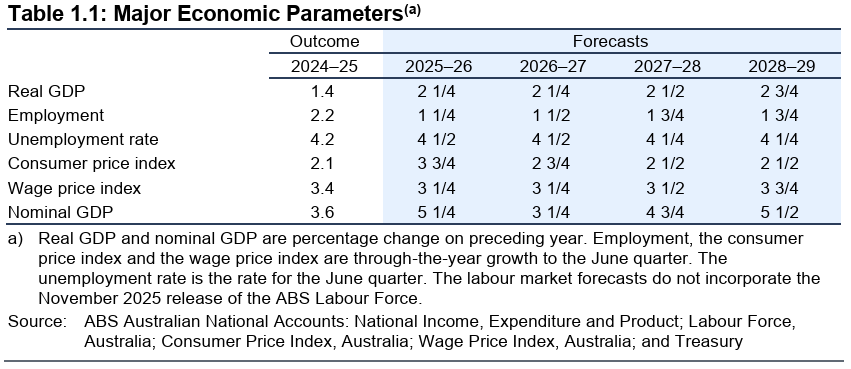

Major Economic Parameters

Budget Aggregates

Domestic Economic Outlook

Real GDP grew 1.4 per cent in 2024–25 and in through-the-year terms was 2.1 per cent in September quarter 2025, the fastest pace in two years. Real GDP growth is forecast to pick up to 2¼ per cent in both 2025–26 and 2026–27.

Inflation remains substantially below its peak in both headline and underlying terms. Recent increases in inflation can be partly attributed to temporary factors, such as the cessation of state electricity rebate schemes, large increases to council property rates and increases in volatile items such as fuel and travel. However, inflation in the prices of new dwellings and market services may be more persistent. Inflation is expected to be 3¾ per cent in 2025–26 and then moderate to 2¾ per cent in 2026–27. Excluding fuels and energy rebates, inflation is expected to sustainably return to the target band by the end of 2026.

The decline in inflation in Australia has been achieved while maintaining gains in employment and participation. Compared to previous disinflationary episodes, the unemployment rate has remained low by historical standards. The unemployment rate was 4.3 per cent in November 2025 (Chart 2.15) and is expected to only modestly rise to be around 4½ per cent over 2025–26 and 2026–27. Growth in employment is forecast to ease. Employment grew by 2¼ per cent in 2024–25 and is forecast to grow by 1¼ per cent in 2025–26 and by 1½ per cent in 2026–27.

Wages growth is forecast to ease slightly but remain well above the pre-pandemic average. The Wage Price Index is forecast to grow by 3¼ per cent in both 2025–26 and 2026–27, well above the five-year pre-pandemic average rate of 2.1 per cent. Real wages have grown in each of the past two years. Real wages are forecast to grow again in 2026–27 and are expected to be ½ per cent higher through the year to the June quarter 2027.

Productivity has grown for four consecutive quarters and a cyclical increase in productivity growth is expected over the forecast period.

National Priorities

Cost-of-living relief

Two further rounds of tax cuts for every Australian taxpayer

The Government is delivering two further rounds of personal income tax cuts. Under these changes, from 1 July 2026 the 16 per cent tax rate, which applies to taxable income between $18,201 and $45,000, will be reduced to 15 per cent. From 1 July 2027, this tax rate will be reduced further to 14 per cent. Combined with the first round of tax cuts, the average annual tax cut is expected to be $2,548 in 2027–28, around $50 per week, compared to 2023–24 tax settings.

Wiping 20 per cent off student debt

The Government is reducing the student debts of more than 3 million Australians by 20 per cent, removing around $16 billion in debt. These changes were applied to the accounts of 3.2 million Australians in November and December 2025.

Backing increases in minimum and award wages

Minimum and award wage workers received a 3.5 per cent increase in wages, effective 1 July 2025. Across the last four FWC Annual Wage Reviews the National Minimum Wage has increased by over $175 per week and $9,120 per year.

Better energy deals for consumers

The Government has reformed the Default Market Offer. As part of these energy market reforms, the Government is introducing the Solar Sharer Offer to provide more households and small businesses with cheap solar energy. This is in addition to, the Cheaper Home Batteries program, the Electric Car Discount.

Cracking down on supermarket price gouging

The Government is banning supermarket price gouging to help Australians get a better deal at the checkout. The ban will come into effect on 1 July 2026, enforced by the Australian Competition and Consumer Commission.Medicare and Health

Medicare and Healthcare

Strengthening Medicare

The Government is investing more than $23.5 billion. The Government is also making medicines on the Pharmaceutical Benefits Scheme (PBS) cheaper from 1 January 2026, with general patient co-payments reduced from $31.60 to $25 per script.

The Government has also expanded the Medicare Urgent Care Clinics program, with 98 clinics established and operating throughout Australia, including 11 opened so far this financial year.

This MYEFO includes significant investments in free mental health services, cheaper medicines, and delivering free health advice and outside hours telehealth through 1800MEDICARE.

More free mental health services

The Government is investing $1.1 billion to deliver more free mental health care. This includes:

- $490.3 million for a new network of 20 Youth Specialist Care Centres.

- $267.3 million for 32 new and upgraded Medicare Mental Health Centres.

- $225.3 million for 58 new, upgraded or expanded headspace services.

- $83.9 million for additional training places for mental health professionals and peer workers.

These commitments build on the $888 million over eight years for mental health measures announced in the 2024–25 Budget to broaden access to high-quality, free mental health care.

Cheaper medicines

The Government is investing $1.8 billion for new and amended listings on the PBS to improve access and affordability of medicines. This builds on the $1.7 billion provided in the 2025–26 Budget for new and amended PBS listings, and Government action to reduce the PBS maximum general co-payment to $25.

Improvements to the Medicare Benefits Schedule

The Government is investing a further $118.1 million this MYEFO for new and amended items on the Medicare Benefits Schedule.

Urgent action to address sexually transmitted infections

The Government is providing $220.5 million for programs that address blood borne viruses and sexually transmitted infections. To address the rising number of cases of infectious and congenital syphilis in Australia, the Government is committing $16.5 million to reduce preventable infant deaths in vulnerable communities.

1800MEDICARE

The Government is investing $219.8 million to establish 1800MEDICARE to help strengthen access to urgent care and take pressure off hospitals. Nationwide 1800MEDICARE is expected to result in the delivery of over 130,000 free telehealth GP services per year by 2029–30.

Buy and Rent a Home

Making it easier to buy and rent a home

This MYEFO makes further investments to deliver more homes for first home buyers, boost the construction workforce and increase the supply of social and affordable housing. These investments are supporting progress towards the Government’s ambitious target of building 1.2 million new homes by June 2029. These measures build on the Government’s first term achievements, including increasing the pipeline of long-term rental properties through Build to Rent tax incentives, raising the maximum rates of Commonwealth Rent Assistance by close to 50 per cent (including indexation), and an historic investment in new crisis and transitional accommodation.

100,000 homes for first home buyers

Through the First Home Supply Program, the Government will partner with states and territories and industry to unlock more housing supply and make it easier for first home buyers to own a home of their own. The Government is investing $2 billion in grants and $8 billion in concessional loans to deliver up to 100,000 homes reserved for first home buyers. State governments will also provide $2 billion in matched funding to get homes underway.

Expanding the 5% Deposit Scheme

The Government has invested $5.4 million over four years to ensure all first home buyers now have access to the 5% Deposit Scheme, with no caps on places or income limits. Further, the changes to the Single Parent stream will allow more single parents and guardians to provide their family with greater security in appropriate homes. Since the 5% Deposit Scheme was expanded it has supported more than 21,000 people into home ownership and more than 200,000 since May 2022.

More social and affordable housing and better First Nations housing outcomes

On 23 November 2025, the Government announced that it will deliver the largest round yet under the Housing Australia Future Fund (HAFF), supporting more than 21,000 new social and affordable homes. This builds on the strong progress made under previous rounds which have contracted 18,650 homes, including 9,284 social and 9,366 affordable homes.

Round 3 of the HAFF includes $3.1 billion in concessional loans for community housing providers, with $2.6 billion in additional investment. This brings the total concessional loan program to $4.5 billion, providing the upfront investment needed to support construction of new homes.

Round 3 will include a dedicated funding stream to improve First Nations housing outcomes and strengthen the First Nations housing sector. This includes $600 million in dedicated funding and access to concessional loans for projects delivered by, or in partnership with, First Nations housing organisations. Round 3 will also introduce a 10 per cent First Nations tenancy target across all social housing delivered in this round. A new First Nations concierge function will be established within Housing Australia to support First Nations organisations through the application and delivery process, and to help build the long-term capacity of the First Nations housing sector.

Closing the Gap through the Housing Policy Partnership

The Government will provide $6 million to extend the Housing Policy Partnership, a key commitment under the National Agreement on Closing the Gap, for two years from 2026–27.

Fast tracking skills in priority industries

The Government is investing $78.0 million to fast track the qualification of 6,000 tradespeople to help build more homes across Australia. In addition, the Government is providing a 12-month extension of the current level of financial support for employers of Australian apprentices training in Key Apprenticeship Program occupations from 1 January 2026. This work builds on other recent reforms including the introduction and permanent establishment of Free TAFE, the establishment of the Key Apprenticeship Program which provides eligible housing construction and clean energy apprentices up to $10,000 over the course of their apprenticeship, and the increases to the Living Away From Home Allowance and Disability Australian Apprentice Wage Support payment. Apprenticeships in priority occupations outside of the Key Apprenticeship Program will receive incentive payments of $5,000 per apprenticeship. This support will be shared equally – with $2,500 for the apprentice and $2,500 for the employer.

Energy and a Future Made in Australia

Investing in cleaner energy and building a Future Made in Australia – Net Zero Plan

The Government built on its commitment to net zero by 2050 and its existing 2030 target by releasing its 2035 emissions reduction target of 62 to 70 per cent below 2005 levels. This formed part of the Government’s updated Nationally Determined Contribution under the Paris Agreement. It was released alongside the Net Zero Plan and the six supporting sectoral decarbonisation plans, which outline an orderly pathway to net zero for Australia.

New measures that amount to over $75 billion in new spending committed since October 2022 to support the net zero transition.

Modernising our energy system

The Government is also progressing key regulatory reforms that enable Australians to further benefit from our world leading take-up of consumer energy resources, such as household solar panels and batteries.

Cheaper Home Batteries

The Government is making changes to the successful Cheaper Home Batteries Program. The changes will implement tiered levels of discounts for small, medium and large batteries, and adjust the existing discount reductions to 2030.

A better energy deal for consumers

The Government is ensuring households and small businesses benefit from small scale consumer energy resources. This includes providing $32.7 million to expand the Nationwide House Energy Rating Scheme and $15.4 million to modernise and reform retail market and consumer protections and implement recommendations of the Nelson Review of the National Electricity Market.

Rewiring the Nation

The Government’s Rewiring the Nation program continues to modernise Australia’s electricity grid by committing over $20 billion to make clean energy more accessible and affordable to consumers. The largest investment under this initiative to date is Marinus Link, which achieved its final investment decision in August 2025 supported by an expected $3.8 billion from Rewiring the Nation.

Future Made in Australia – Supporting major investments in decarbonisation

The Government is strengthening Australia’s industrial capabilities by establishing a $5 billion Net Zero Fund within the National Reconstruction Fund.

Cleaner Fuels

In addition to the Net Zero Fund, the Government is investing $1.1 billion in low carbon liquid fuels through the Cleaner Fuels Program. This builds on investments made in renewable hydrogen, green metals, critical minerals and clean energy manufacturing that position Australia to realise the economic opportunities presented by the global net zero transformation.

Critical minerals

The Government is supporting the development of Australia’s critical minerals industry by committing $1.2 billion to deliver the Critical Minerals Strategic Reserve and helping to further secure the supply chains of critical minerals and rare earths required for defence, advanced technologies and clean energy manufacturing.

Through the Critical Minerals Facility, the Government is providing USD$100 million in equity financing to Arafura Rare Earths for the Nolans Rare Earths project in the Northern Territory. This builds on existing government support for the project and will help crowd in private investment. The Government is also providing equity financing to Alcoa of Australia for the Alcoa-Sojitz Gallium Recovery project in Wagerup, Western Australia. This is a joint project with Japan and the United States, which will strengthen our collective economic security.

Supporting Australia’s heavy industry transition and securing regional jobs

The Government is making targeted investments to sustain strategically important smelting capabilities. As part of this effort, the Government is providing $135 million in joint support with the South Australian and Tasmanian Governments to Nyrstar’s Port Pirie and Hobart facilities, including accelerating a feasibility study relating to the production of the critical mineral antimony.

The Government is partnering with the Queensland Government to provide up to $600 million in support over four years, helping to secure regional jobs and reinforce Australia’s position in the global copper supply chain.

Building on the February 2025 joint commitment of $2.4 billion to stabilise and secure the longer-term future of the steelworks, in July 2025 the Government announced a further $275 million in joint administration funding

Supporting a sustainable forestry industry

The Government is helping secure a sustainable future for timber and forestry workers by establishing a $300 million Forestry Growth Fund. The Forestry Growth Fund includes $150 million in concessional finance from the National Reconstruction Fund to modernise timber processing. A further $150 million in grants will fund training and support for forestry workers, further innovation in engineered wood products and support the housing construction supply chain.

Strengthening the manufacturing sector with zero interest loans

The Government is delivering its election commitment to establish a new Economic Resilience program within the National Reconstruction Fund to provide $1 billion in zero interest loans for Australian manufacturing businesses.

Economic Reform

Boosting productivity and creating a single national market

The Government is working with the states and territories to expand National Competition Policy reforms and reduce barriers and costs across the federation.

These reforms include:

- Working towards a single national market for workers through broad and ambitious occupational licensing reforms, with an initial focus on occupations critical to housing and construction.

- Working towards a single national market for goods through regulatory and standards harmonisation, starting with reforms in three priority sectors (building and construction, waste and recycling, and household electrical consumer products), and identifying relevant reforms from the Food Standards Australia New Zealand Act Review to promote grocery and supermarket competition.

- Delivering a package of heavy vehicle reforms to increase transport productivity and support the uptake of heavy zero emissions vehicles.

- Allowing health professionals to work to their full scope of practice to increase access to care, alleviate skills shortages and reduce costs, starting with the harmonisation of state and territory drugs and poisons legislation.

- Expanding right to repair to agricultural machinery to enhance productivity through improved access to repair and maintenance information.

Investor Front Door and accelerating approvals

The Government has committed $17.3 million to pilot Investor Front Door services until early 2027. The Government will consult on options for a dedicated Coordinator General function as part of the Investor Front Door in 2026.

Reforms to better protect the environment while boosting productivity

The Government has passed landmark environmental law reforms, heralding a new era that will better protect our environment and boost productivity. The reforms include a new Streamlined Assessment Pathway that will significantly reduce the timeframe for proponents who provide sufficient information upfront.

Abolishing nuisance tariffs

A second tranche of around 500 nuisance tariffs will be abolished from 1 July 2026 to make products cheaper for Australians and reduce compliance costs for business by an estimated $127 million per annum.

Reducing the regulatory burden for builders

The Government has worked with states and territories to pause further residential changes to the National Construction Code (NCC) until 2029, excluding essential safety and quality changes. During the pause, the NCC will be modernised to make it more streamlined, easy to use, and cost effective while upholding high standards, quality and safety.

Capturing opportunity through the National AI Plan

The Government has released the National AI Plan, which will help Australia capture the opportunity of AI and ensure the benefits of AI are widely shared, while keeping Australians safe. The Government is also establishing the Artificial Intelligence Safety Institute to monitor, test and share information on emerging AI capabilities, risks and harms.

Delivering on transport infrastructure priorities

The Government is maintaining its more than $120 billion 10–year infrastructure investment pipeline. This MYEFO, the Government is providing an additional $1.1 billion over seven years from 2025–26 to support the delivery of election commitments and other priority projects under the Infrastructure Investment Program, while continuing to smooth the medium-term investment pipeline.

To support operations at the new Western Sydney International Airport, the Government will provide more than $261.8 million for a further stage of preparations by border agencies.

Community infrastructure grants

The Government is investing $625.5 million over four years from 2025–26 to fund community infrastructure that improves the social and economic vitality of local communities.

A further $87.5 million over four years from 2025–26 will protect and improve Australia’s environment and heritage.

A stronger and more efficient public service

The Government will achieve savings of $6.8 billion by further reducing spending on external labour and other non-wage expenses like travel, hospitality and property. To unlock the full potential of AI in public service delivery, the Government is continuing to build AI capability, confidence and coordination across the APS.

Social Services

Broadening opportunity and advancing equality – Fairer superannuation for low-income workers

The Government is boosting the Low Income Superannuation Tax Offset (LISTO) to provide additional support to low income workers to help build their retirement savings. From 1 July 2027, the LISTO threshold will increase from $37,000 to $45,000 to match the top of the second income tax bracket. The maximum payment will also increase to $810 to account for recent increases in the Superannuation Guarantee rate. The boost to LISTO will help deliver a more secure retirement for 1.3 million Australians.

First Nations economic empowerment

The Government will provide an additional $75 million to support Prescribed Bodies Corporate to build capability and accelerate investment, enabling meaningful participation for communities and timely decision-making for investors.

A more accessible health and aged care system for Australians – Improving access to quality aged care services

The Government is supporting thousands more older Australians to continue living in their homes and communities by providing an additional 63,000 Support at Home places by 30 June 2026. This builds on the 20,000 Home Care Packages that were released before the aged care reforms commenced on 1 November 2025. This represents a total additional investment in in-home support of $947.8 million over two years from 2025–26.

Better health outcomes for regional Australia

In this MYEFO the Government is making a number of investments to improve access to health care in regional and remote communities. This includes $10.1 million to CareFlight for aeromedical retrievals and care in the Top End region of the Northern Territory. A further $2.0 million will strengthen preventive health and health promotion activities for communities in Cairns and Far North Queensland, including cancer screening and skin cancer checks.

In addition, the Government is committing $73.4 million to strengthen and support Australia’s health workforce in regional, rural and remote areas. This extends funding for seven programs that support medical professionals to deliver essential health services in areas of need.

Equitable health care for men, women and families

In this MYEFO the Government is investing $82.6 million to provide essential health supports for men, women and families. This includes funding of $32.7 million across five programs to support men’s health and reduce stigma around seeking support. In addition, the Government is providing $16.0 million to continue the Australian Longitudinal Study on Male Health (Ten to Men), which provides data on the health needs of men and boys. Funding will also support research and education on the prevention, early detection and management of diseases affecting women and girls.

Stronger social services for everyone – A fairer and more efficient social security system

The Government is making the social security system fairer and more efficient by increasing the small debt waiver threshold to $250, recognising that the cost of recovery for small, accidental debts generally exceeds the value of the debts themselves.

Helping veterans and their families

The Government is providing $1.4 billion over four years to deliver better outcomes for veterans and their families. A new executive agency focussed on veteran wellbeing will be established with $78.0 million, as recommended by the Royal Commission into Defence and Veteran Suicide (the Royal Commission). The Defence and Veterans’ Service Commission will be provided with $44.5 million, giving effect to another recommendation of the Royal Commission.

Safer and better early childhood education and care

The Government will provide $188.5 million over four years from 2025–26 to strengthen safety and quality in early childhood education and care. The Government is also investing $39.3 million to address existing gaps in the Working With Children Checks (WWCC) process and to implement the National Continuous Checking Capability to provide all jurisdictions near-real time information on the suitability of WWCC holders across the country.

The Government has also introduced a new combined fee growth cap over 2 years to assist more childcare services to take up the WRP at the same time as limiting fee growth for families.

From January 2026, the 3 Day Guarantee replaces the Child Care Subsidy Activity Test. Families will be eligible for at least 72 hours of subsidised early childhood education and care per fortnight, with 100 subsidised hours per fortnight for families caring for a First Nations child, regardless of parents’ level of work, training, study or other activity.

Securing our ‘Home and Region’

Delivering the Henderson Defence Precinct

The Government has committed an initial $12 billion over ten years towards delivering a Defence Precinct at Henderson in Western Australia.

Improving emergency capability – Better and more resilient emergency warning systems

A new National Messaging System will provide Australians with cell broadcast warnings during emergencies. The Government has committed $19 million to complete the National Messaging System to ensure it is in place for the 2026–27 high risk weather season. In addition, the Government will provide $11.6 million to improve Australia’s capacity to prepare for, monitor and respond to natural hazards including bushfires.

Safeguarding Triple Zero

The Government will provide over $23.4 million to the Australian Communications and Media Authority for regulatory oversight and compliance activities to improve the resilience of the Triple Zero emergency call service.

Investing in regional and remote Australia – Strengthening the Regional Investment Corporation

The Government is supporting the growth, resilience and sustainability of Australia’s agricultural sector with an additional $1 billion available for new loans through the Regional Investment Corporation (RIC). This new funding brings total support for the agriculture sector through RIC loans to over $5 billion.

Keeping Rex in the air

The Government is providing financial support for the sale of Rex Airlines to new commercial owners. Rex’s existing debt will be restructured and a new commercial loan facility of up to $60 million will be provided in exchange for a range of commitments aimed at maintaining regional connectivity.

Addressing algal bloom outbreaks and combating ghost nets

The Commonwealth is contributing $68.5 million to help South Australians respond to the algal bloom outbreak currently affecting state waters. The Government is expanding funding to detect, remove and dispose of discarded fishing nets and marine debris from Australia’s northern waters, with $25.1 million over four years for the Ghost Nets Initiative.

Strengthening Australian leadership in Antarctica

The Government is securing the future of Australia’s Antarctic Program with an investment of $208.8 million for critical shipping and aviation to support the Australian Antarctic Program, including the delivery of additional world-class marine science voyages.

Supporting multicultural communities

The Government is investing $220.6 million over four years from 2025–26 to support multiculturalism in Australia, to strengthen and support multicultural communities; and promote inclusion, economic participation and stronger community connections. This includes $171.3 million over three years from 2025–26 for grants to community organisations to support the delivery of priority infrastructure, amenities and events initiatives. It also includes $25.6 million over four years from 2025–26 to support over 600 community language schools across Australia, which will benefit over 90,000 students.