Reform of Merger Regulations

On Wednesday the 10th of April, Federal Treasurer Dr Jim Chalmers MP announced changes to Australian merger regulation. At the Bannerman Competition Lecture, co-hosted by the Australian Competition and Consumer Commission (ACCC) and Business Law Section of the Law Council of Australia, Chalmers reinforced the need for greater transparency and increase to the ACCC’s remit.

These reforms confer greater powers on the ACCC to prevent companies from engaging in mergers that harm market competition and to boost competition and productivity.

Background

The changes respond to the Treasury’s Competition Review announced in late 2023.

Currently around 330 mergers have been assessed through Australia’s voluntary disclosure system out of approximately 1400 mergers in total. The ACCC has argued that they are currently constrained to post merger court challenges where it believes there is consumer harm.

Key Changes

Mandatory Notification

The new system will require the approval of the ACCC to approve all mergers above an unconfirmed threshold, in contrast to the voluntary system currently in place. These specifics would be captured within the legislation that will go before Parliament but likely allow discretion for smaller mergers while setting a monetary and market share threshold. A public register will also be introduced to reflect all mergers notified to the ACCC.

Timeline

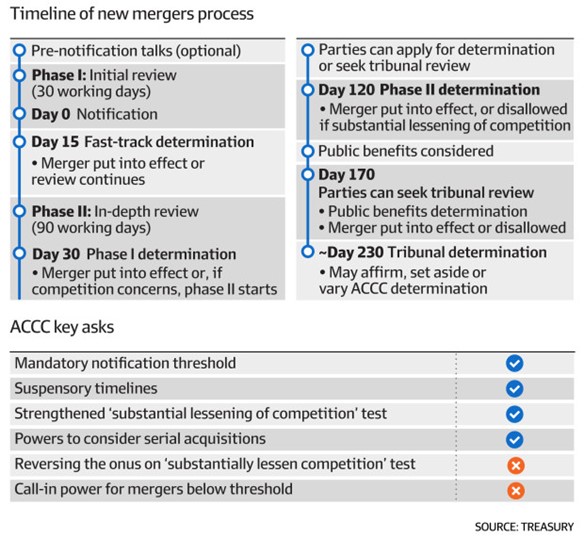

The change will introduce a faster decision making process.

Serial Acquisitions

Serial, ‘creeping’ or industry ‘roll-up’ acquisitions occur when a number of smaller companies within the same industry are consolidated overtime into a bigger company. These measures are not covered by the current arrangements. The reform will confer the ACCC the power to block serial acquisitions unless companies can prove that it wouldn’t substantially lessen competition.

Disputes

The responsibility of adjudicating disputes rests with the Australian Competition Tribunal costing between $50,000 and $100,000 per review. Under the changes small businesses will gain an exemption from these fees but the requirement details are yet to be determined.

What’s not changing?

There is no change to the current test where the ACCC only acts if a transaction substantially lessens competition. There is also no change to the current onus of proof.

The current requirements around notification of below-the-threshold mergers to the ACCC by foreign investors will remain.

The ACCC will not otherwise review below threshold mergers once set by legislation.

Subject to passage through Parliament, the new regulations are due to come into effect on 1 January 2026.

The joint media release of Treasurer Chalmers and the Assistant Minister Leigh can be found here.

The media release from the ACCC can be found here.

For more information, please contact Hawker Britton’s Managing Director Simon Banks on +61 419 648 587.