Queensland 2022-23 Budget

On Tuesday 21st of June 2022, Queensland Treasurer Cameron Dick delivered the 2022-23 Queensland Budget. This is the Palaszczuk government’s eighth budget as the state continues to recover from the economic impacts of the pandemic.

Queensland has the fastest growing population in the country and the treasurer has marked this as the “budget for tomorrow”. It marks the start of a decade-long infrastructure pipeline leading up to the 2032 Olympic and Paralympic Games.

Fiscal Outlook

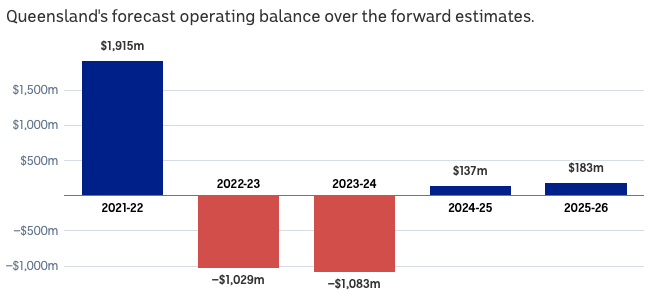

A net operating balance of $1.9 billion is expected for 2021–22, driven by the revenue impacts from the temporary surge in coal and oil prices and an increase in housing activity. The net operating position reverts to a modest deficit across 2022–23 and 2023–24 and is then expected to return to surplus from 2024–25 consistent with previous forecasts.

The additional revenue in the 2022–23 Budget is being directed towards measures that address the increasing demand for key services.

Over the 5 years to 2025–26, revenue is expected to grow at 4.5 per cent on average per annum, compared to 4.1 per cent for expenses.

Forecast borrowings have been progressively revised downwards since the 2020–21 Budget due to prudent fiscal management. General government borrowings are expected to be $3.6 billion lower by 2024–25 than forecast in the 2021–22 Budget Update, and $4.5 billion lower than forecast in the 2021–22 Budget.

Revenue

The 10-year freeze on coal royalties in Queensland will come to an end on June 30.

To reflect the new price of coal being achieved, three new progressive coal tiers would be introduced on 1 July 2022:

- 20 per cent for prices above $175 a tonne

- 30 per cent for prices above $225 a tonne

- 40 per cent for prices above $300 a tonne.

The Queensland government has also announced a new levy on big business to generate an ongoing funding source for mental health services in the state

- Large businesses with a payroll of more than $10 million will need to pay a levy of 2.5 cents for every $10 of taxable wages they pay above $10 million.

- Businesses that have a payroll of more than $100 million, such as major supermarkets, will pay an additional levy of five cents for every $10 of taxable wages they pay above $100 million

- The levy is expected to deliver an annual windfall of $425 million within three years.

Queensland’s Gambling Tax

- Queensland’s Gambling Tax will rise from 15% to 20%

- The additional 5% will be paid by Gambling Companies and not the individual

- The Gambling Tax will also now be applied to bonus bets

- This is expected to bring in $80 million in revenue

Budget Commitments

Cost of living

- Queenslanders will automatically receive a $175 Cost-of-Living Rebate on their next power bill.

- Cost of $385 million to the budget.

- $6.8B in concessions for Queensland individuals, families and businesses in 2022–23

- $541.3M in 2022–23 for government-managed housing rental rebates

- An increase of $178.2M from 2015–16

- $2.1B in 2022–23 in general transport concessions for bus, rail and ferry services.

- An increase of $800M from 2015–16

- $1.3B in 2022–23 in energy concessions to provide affordable power to households and businesses.

- An increase of $610.5M from 2015–16

- Up to $590 in school textbook and resources allowance,

Housing

- $741M Resilient Homes Fund jointly funded by the Queensland and Australian Governments under DRFA for homeowners to bolster resilience across 37 council areas

- $1.9 billion will be available through the Housing Investment Fund over 4 years to boost housing supply and increase housing and homelessness support across Queensland.

- Under the plan, the government will deliver 7,400 new dwelling commencements across Queensland.

- A partnership with Brisbane Housing Company has been secured to build 118 new social and affordable homes

- $10 million per year ongoing to support initiatives to address youth homelessness

- $175 Cost-of-Living rebate and an average rental benefit of around $9,900 to help low-income families in social housing with 2 senior high school students

- $200M over 3 years to increase the Catalyst Infrastructure Fund as well as a I’mnew Growth Acceleration Fund to unlock development and support the delivery of trunk infrastructure and increase the supply of housing in priority development areas

Health

The 2022–23 Budget provides $23.6 billion in 2022–23 and a $9.785 billion capital boost to the health system over 6 years.

- 2,200 additional overnight beds across 15 facilities over the next 6 years

- $1.5B health capital spend in 2022–23

- $22B in 2022–23 for health and ambulance services, supporting thousands of frontline jobs

- $1.6B for mental health over 5 years plus an additional

- $28.5 million in capital funding to support the Better Care Together plan for mental health, alcohol and other drug services

- $943.5M over 7 years to extend the Building Rural and Remote Program to upgrade infrastructure in rural and remote areas

- $333.7M over 10 years supporting the Royal Flying Doctors Service

- $60.3 million for the Queensland Regional Aeromedical Hub

- $73.9M towards critical Queensland ambulance infrastructure projects

- $40M to provide free influenza vaccinations for all Queenslanders up to 30 June 2022

- $750M to build the Queensland Cancer Centre at Royal Brisbane and Women’s Hospital

Renewable Energy and the Environment

- $48M towards pumped hydro energy storage projects

- $3.5M over 3 years for the continuation of the Great Barrier Reef Education Experience Program to support Queensland’s reef tourism

- $30M is open for councils to assist with the clean-up of their regions

- $262.5M toward protected area investment and management of ecosystems, natural resources and habitats

- $40M to help protect Queensland’s native animals at risk across South East Queensland, including $24.6 million to support the South East Queensland Koala Conservation Strategy 2020–2025

Manufacturing, Trade and the Economy

- $59.1B capital program over the next 4 years

- $150M over 10 years towards a new Queensland Trade and Investment Strategy for TIQ to enhance Queensland’s trade opportunities

- $291.8M for resource recovery initiatives

- $68.5M over 5 years to implement the Queensland Resources Industry Development Plan

- $66.4M over 4 years for tourism recovery and development initiatives

- $50M over 2 years to support Queensland manufacturers

- $35.5M to support the expansion of the Translational Research Institute

- $39.1M to support small business growth

- $13.8M increased funding over 6 years towards the Far North Queensland film studio

Communities

- $80.2M increased funding over 3 years towards Activate! Queensland 2019– 2029 to maximise opportunities for Queenslanders to increase physical activity, taking total funding to $394 million

- $31.4M increased funding from 2023–24 to extend the 2032 HighPerformance Strategy to help prepare elite Queensland athletes for Paris 2024 Olympic and Paralympic Games, Los Angeles 2028 Olympic and Paralympic Games, and leading up to Brisbane 2032 Olympic and Paralympic Games

Safer Communities

- $2.9B in 2022–23 for policing, as well as $174.6 million for the police capital program, to support quality frontline police services

- $500 million per year ongoing for child protection services in response to ongoing pressures arising from an increase in demand

- $125.6M over 4 years and $19 million per year ongoing to strengthen social services in Queensland $363M over 5 years

- $$78.8M increased funding over 4 years and 18.9 million per year ongoing to continue Youth Justice Strategy reforms

- $61.3 million ongoing as part of the Queensland Government response to the Queensland Women’s Safety and Justice Taskforce, Hear her voice – Report one – Addressing coercive control and domestic and family violence in Queensland, for system-wide reform and criminalising coercive control.

- $19.2 million over 4 years for specialist domestic, family and sexual violence support services and programs for women in custody

Infrastructure

- $1.2B increased funding for new schools and new and upgraded infrastructure in existing schools

- $19.6B in 2022–23 for education and training including TAFE services across Queensland $2.2B over 5 years

- $27.2M over 4 years and $11.7 million per year ongoing to provide an uplift in bus services for highest priority areas, such as northern Gold Coast services

- $40M over 5 years to improve school travel safety in and around Queensland schools and drop-off zones

- $199.5M towards priority regional water infrastructure projects including Cairns Water Security Program, Hughenden Water Bank, Lansdown Eco-Industrial Precinct and the Mount Morgan Pipeline

- $70M for the Townsville Connection Road, Bowen Road bridge duplication as part of a $7.3 billion transport capital spend

- $721M extraordinary circumstances package jointly funded by the Queensland and Australian Governments under DRFA, to address recovery needs for impacted communities

- $3.5 billion for rail projects including:

- $924 million towards the $1.22 billion Gold Coast Light Rail Stage 3

- $489 million towards the $550.8 million Beerburrum to Nambour Rail Upgrade Stage 1

- $876 million towards the $2.6 billion Logan and Gold Coast Faster Rail

For more information, please contact Hawker Britton’s Managing Director Simon Banks on +61 419 648 587 or Emma Ramage on +61 430 811 929.